Adjusting Your Retail Business for a Post-COVID World

Well before COVID turned the retail industry (and the world) on its head, heritage fashion brands that built their businesses with a large physical store presence and seasonal drops of massive assortments were in trouble and they knew it.

According to McKinsey & Company, despite overall retail sales being down 30% since the beginning of the pandemic, online shopping is up 15% - 40% depending on the type of products. The pandemic catapulted consumers forward forcing traditional in-store shoppers to embrace ecommerce in all aspects of daily life.

More consumers than ever before are discovering the ease of online shopping. Not only do they realize the convenience, but it provides ensured safety for consumers being able to shop from the comfort of their own home.

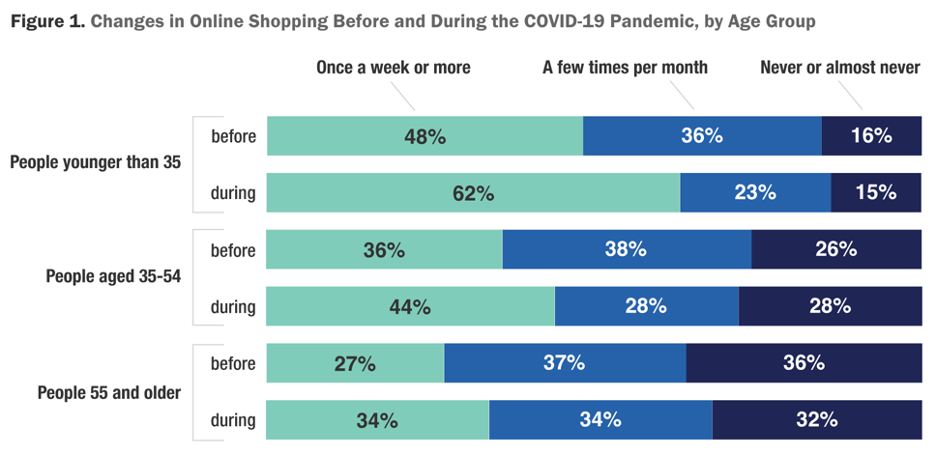

This graph illustrates shopping habit changes by age before & after the Pandemic.

As consumers continue to change their shopping behavior and expectations of a compelling shopping experience, retail brands must adjust their businesses to align with their needs.

Here are 4 strategies fashion brands should focus on to thrive in this new retail environment.

Focused Assorting for Online Shoppers

For many years, traditional retailers have delivered large product collections to refresh their floors for seasons and holidays. When almost all of the products were being sold solely in stores, consumers were trained to stop in at these specific times to shop. Consumers also had to plan a considerable amount of time to drive out to a mall and shop around the physical floor before purchasing.

Because shopping online takes a matter of minutes vs. hours, consumers are checking in on their favorite brands much more frequently than before. Big assortments of product delivering all at once doesn’t align with the current ecommerce shopping expectations of continual newness.

Small MOQ Production

Because consumers now expect this constant newness, it’s now more important than ever that retail brands find profitable low MOQ sourcing solutions.

Unless brands have proven season-less high-volume products, they can no longer produce thousands of units with overseas suppliers to hit value production costs.

It’s imperative for brands to have production partners that are adjusting to these new expectations, supporting you in your quest to profitably provide continued newness to your customers.

Our overseas partners have realized this shift in manufacturing scale and are adjusting their offerings to accommodate a high sell-through business model. They offer low MOQ options for materials and production giving brands affordable production options without a risky over production of inventory.

Diversifying Your Supply Chain

Even before COVID, having a diversified supply chain portfolio has been an important strategy for successful fashion brands.

With volatile changes in political climates, natural disasters, and now pandemics, it’s easy to see that having a variety of partners to help you execute for your customer can minimize the risk of losing production and ultimately sales.

I always tell brands to focus on having 3 different supply chains options:

Domestic Production Partner

Even though this option is usually higher priced, there have been many advancements in US production capabilities as well as consumer focus on US made goods.

I suggest using these factories for lower quantity products and chasing into best-selling inventory for a fast turnaround.

International Production Partner

This would be your lower cost strategic production partner for volume and scale.

You would build a plan for long-term growth with this partner.

Back Up International Production Partner

You should always be exploring and vetting new relationships to minimize the impact of losing your key volume production partner.

When issues like tariffs or natural disasters arise, you can already have a partner in your back pocket that has been product tested and ready to jump in if you need them.

DTC Brand Advantage

Due to COVID, 76% of Americans tried a new brand, place to shop or shopping method. Not only were they compelled to try new brands, but most of these shoppers intend to continue trying new methods of shopping and brands that align with these new and convenient ways of shopping. (McKinsey & Company)

Customers are changing their ways and now is the time to reach them.

With the deterioration of established brand loyalty, this offers a wonderful opportunity for newer DTC brands to build their customer base and grow their business.

Questions You Should Ask Yourself

How have my consumers' shopping behavior changed since COVID?

Am I offering consistent newness to my customers?

Am I producing inventory that maintains a healthy sell through?

Do I have production partners that can offer lower MOQ production that fits within my profit goals?

If issues arise in my current supply chain, do I have a viable backup plan for production?

What is my marketing strategy to reach new consumers that may be more open to trying new brands?

These post-COVID customers expect consistent freshness in color and products to stay engaged with your brand.

COVID has forever changed the retail landscape and consumer shopping habits around the world. As consumers change, so do fashion brands. Focusing on these modifications can help you to align with their expectations to build lasting customer relationships and create a foundation for success in this new landscape.